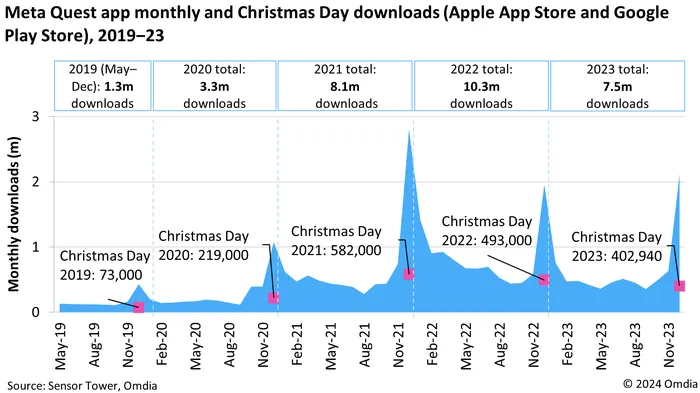

The Meta Quest platform continued to lose momentum in 2023. Omdia analysis of Sensor Tower data reveals that the associated app was downloaded by a combined 7.5 million iOS and Android device users in 2023. This is a 25% reduction on 2022 where it achieved a record 10.3 million downloads (see: Over 10 million people downloaded the Meta Quest app in 2022, up 27% on 2021).

It also marked the second consecutive drop in Christmas Day downloads, which fell to just over 400,000 – 18% lower than in 2022 (see Figure 1). The last three months of 2023 overperformed by 8% compared to 2022, indicating that the launch of the Quest 3 and holiday sales made a significant positive impact.

As assessed in Omdia’s latest Consumer VR Headset and Content Revenue Forecast, 2023 was a challenging year for the industry, with headset sales declining by 24% and all key devices underperforming. Further downturn is expected in 2024 and 2025 – see: VR industry braces for setback: Omdia forecasts declining sales until 2026.

While not an exact representation of Quest 2 headset sales, Meta Quest app download figures serve as a good barometer, given the mobile app must be downloaded as part of the initial setup of the headset. Sensor Tower does not count re-downloads, app updates, or subsequent downloads on new or additional devices for an existing iOS/Google Play account. However, upgrades to the Quest 3, the second-hand market, and instances where owners lend headsets greatly complicate the efforts to align app download figures precisely with headset sales.

Figure 1: Meta Quest mobile app downloads over past five years

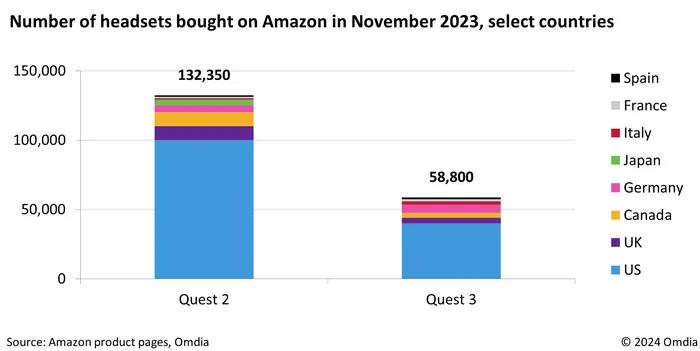

Meta Quest headset sales remain heavily concentrated in the US

According to data from Amazon product pages, November 2023 witnessed sales of at least 191,150 units for both Quest 2 and Quest 3 headsets across eight key countries (see Figure 2). 73% of those sales were on the US site. Typically, November marks peak VR sales due to Black Friday and Cyber Monday; Meta offered the 128GB Quest 2 at a reduced price of $250 (which has since become a permanent adjustment), while Quest 3 maintained its original price of $500. This disparity significantly contributed to Quest 2 outselling Quest 3 more than two to one based on the Amazon figures.

Meta’s limited release of compelling AR content utilizing Quest 3’s enhanced passthrough capabilities also likely hindered its appeal for existing Quest 2 owners. As most Quest Store content remained compatible with Quest 2, many consumers likely perceived Quest 3 as an incremental improvement that didn’t warrant the upgrade. Meta’s priority moving forward will be to change this sentiment, but this will take a lot of time and investment.

Figure 2: Quest 2 outsold Quest 3 by a factor of 2.25 during the Black Friday sales month

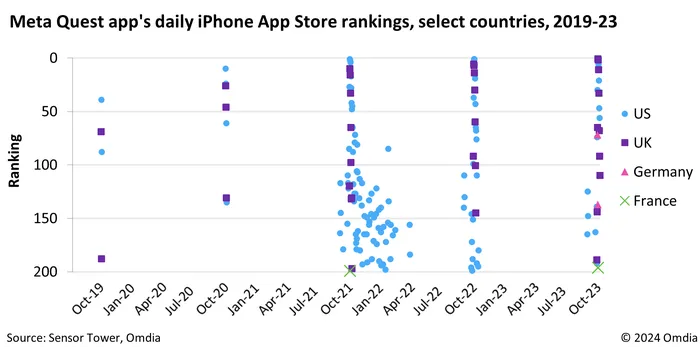

The Meta Quest smartphone app ranking data underlines the seasonal nature of headset sales and their US-centricity

The Meta Quest smartphone app’s recurring appearance in the top 200 free app rankings during the holiday season aligns with the seasonal trend of headset sales, particularly around Christmas when these devices are popular gifts. This pattern demonstrates a predominantly US-centric trend closely followed by Canada and UK, but with very limited movement in other leading VR markets such as Germany and France (see Figure 3).

The Meta Quest app secured positions in the top 10 free app downloads chart on Christmas week in just a handful of countries: Canada, Ireland, Norway, the UK, and the US.

Figure 3: iPhone App Store ranking data underlines Meta Quest headsets’ seasonality and prominence in the US

While the recurring appearance of the Meta Quest smartphone app at the top of the rankings during the holiday season signals positive interest and aligns with peak VR headset sales, it’s essential to view this in a broader context. Despite the surge in popularity and peak concurrent users engaging in VR games during these periods, the larger issue persists. Engagement throughout the year is inconsistent, posing a significant hurdle to Meta’s ambition of cultivating a self-sustaining VR ecosystem. The fundamental challenge remains the scarcity and limited inflow of genuinely immersive VR experiences which are needed to bolster consumer interest beyond seasonal spikes.